What Is FatFIRE? Things To Know

Financial Independence Retire Early (FIRE) comes in a variety of forms, including FatFIRE. Being wealthy enough to retire early is the definition of Fat FIRE. If you are Fat FIRE, you can easily survive without a job because your investment income more than covers your best life’s living expenses. To find out more about Fat FIRE, read this article.

What Is FatFIRE

The term “Fat FIRE” refers to early retirement with a higher standard of living.

A general definition is having enough money to be able to spend at least $100,000/year in retirement. This requires a portfolio with a minimum value of $2.5 million in accordance with the 4% rule.

This gives you the freedom to practice frugality or budgeting. Spending nothing is possible while living your best life!

Many people find this kind of FIRE appealing because you don’t have to give up life’s comforts. Additionally, knowing that you have more breathing room in case life throws you a curveball makes you feel more at ease.

The unexpected can happen in life. Having more money gives you protection during trying times.

Types Of FIRE

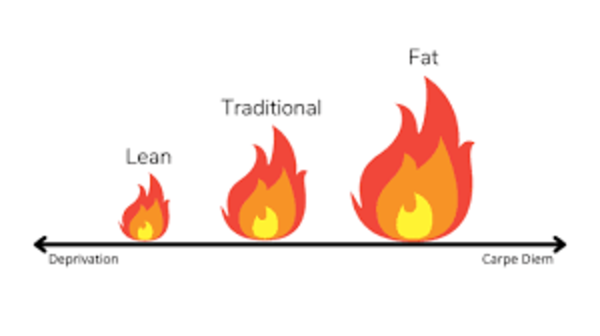

There are now many different types of FIRE as the movement continues to expand.

The various FIRE types are listed below, from easiest to most difficult to accomplish:

- CoastFIRE (Coast FIRE)

- BaristaFIRE (Barista FIRE)

- LeanFIRE (Lean FIRE)

- TraditionalFIRE

- FatFIRE (Fat FIRE)

Every FIRE strategy has benefits and drawbacks, and they all revolve around juggling work and money.

- Coast FIRE is having enough invested to stop contributing and still reach FIRE in the future.

- Barista FIRE is working part-time for supplemental income or health insurance.

- Lean FIRE is the minimalist way of reaching FIRE and denotes a “lean” retirement budget.

- Traditional FIRE is retiring early after accumulating 25 times your annual expenses.

- Fat FIRE is having a large amount of money to retire early

This gives us the choice to pursue the FIRE that best suits our lifestyle objectives.

What Fat FIRE Allows You To Do

- Live in the most expensive cities in the world, which all have a wonderful culture, food, nightlife, entertainment, schools, arts, and better weather

- Live in a comfortable house with at least three bedrooms, two bathrooms, and a yard if you have one or more kids, or a luxury two-bedroom or greater condo if you are a childless couple or individual

- Save or have enough to pay for all your children’s college education

- Travel for 8 or more weeks a year while living in 4 or 5-star hotels

- Drive a safe and reliable car that’s not older than five years

- sashimi, wagyu steak, and other fine cuisines. jamon iberico, caviar etc)

- Afford excellent healthcare (gold plan or higher without needing subsidies)

- Take care of all your parents’ financial needs since they sacrificed so much to raise you

- No need for either partner or spouse to work every again

Calculating FatFIRE

Two elements will determine how FatFIRE is calculated:

- Yearly Spending In Retirement

- Current Savings Per Year

We are now capable of estimating our annual spending.

Finding out your savings rate is the next step. You put this amount aside every year. You can determine how long it will take to get to FatFIRE using these two values.

I suggest using my FIRE calculator because it tracks your advancement annually. You will know exactly when you will get to Fat FIRE in this way.

You can estimate when you will reach your FatFIRE amount by using my FIRE calculator. The FIRE calculator takes into account both your contributions and savings.

Here Is An Example:

- Yearly Spending In Retirement ($100,000)

- Current Savings Per Year ($74,000)

FatFIRE Number = (25 X Yearly Spending)

$2.5 Million = (25 x $100,000)

Fat FIRE Number = $2.5 Million

The FIRE calculator is now being used to calculate when we will reach this amount.

Compared to normal FIRE, it will take more time.

Pros And Cons Of Fat FIRE

Pros Of Fat FIRE

Fat FIRE Provides A Great Amount Of Financial Flexibility

Having a larger investment portfolio, which is required for Fat FIRE, offers a lot of financial flexibility.

This financial adaptability can be seen in a variety of ways, including:

- Increased hedge against market fluctuations

- Decreased spending levels can still afford a comfortable lifestyle

- Decreased risk of losing one’s financial independence status and having to return to work

- Ability to decrease one’s safe withdrawal rate during a down market

Fat FIRE is a desirable option because of its unrivaled financial flexibility.

Fat FIRE Makes A Frugal Lifestyle Optional

It takes some degree of frugal living to save money on the road to financial independence.

The ability to make elements of previous frugal lifestyles optional after achieving Fat FIRE comes from our savings being able to cover our higher standard of living.

So instead of worrying about finding ways to save money wherever we can, we can concentrate on taking pleasure in the aspects of our lives that make us the happiest. We are able to splurge a little.

Cons Of Fat FIRE

Fat FIRE Can Facilitate Lifestyle Inflation

A higher standard of living is made possible by Fat FIRE.

A new “normal spending level” could unintentionally be established by this higher standard of living.’

This can be risky for people who believe that buying things makes them happy because, if lifestyle inflation occurs, it will ruthlessly deplete their savings.

The funds provided by Fat FIRE cannot be used in any way. So it’s more crucial than ever to make sure we are employing a secure withdrawal strategy.

Fat FIRE Takes Longer To Achieve

When earning six figures compared to an average income, Fat FIRE is much more doable.

Realizing Fat FIRE can undoubtedly be expected to result in a few more years of employment, even after taking compound interest into account. And if you’re a member of the anti-work movement, you might want to avoid doing this.

Don’t feel obligated to give up more years of your life to Fat FIRE if you are happy with the way things are.

Fat FIRE Vs Lean FIRE

Lean FIRE, in contrast, is a net worth benchmark that assumes you’ll only have minimum expenses for food, housing, and transportation in retirement. Lean FIRE is sometimes referred to as a way of life where your current annual spending will stay below $40,000/year in retirement.

According to the Trinity study, such a lifestyle would call for an investment portfolio worth $1 million. In contrast, Fat FIRE estimates annual expenses of over $100,000/year in retirement, necessitating a $2.5 million portfolio.

Your Lean FIRE number will be reached and passed if you are working toward your Fat FIRE number.

Fat FIRE Vs FIRE

Though the numbers are identical between fat and regular FIRE, Fat FIRE has larger totals. You desire a lifestyle that will have higher monthly costs, so increasing your FIRE number and annual investment income will be necessary and may take longer to accomplish.

Davis and his wife currently have a net worth of about $600,000 and are expected to surpass $7 million in the following two years. “We still have a ways to go to reach some of our objectives, he says. “However, rather than retirement itself, it’s more about comfort, flexibility, and assurance.”

Be aware that some people achieve FIRE and retire early with only $1 million or less in retirement savings. The $2.5 million network benchmark can seem high.

Fat FIRE Vs Coast FIRE

Coast FIRE is a retirement planning strategy in which your accounts have enough money invested to let compound interest get you the rest of the way to your FIRE number.

When you reach your Coast FIRE number, you can stop making contributions to your retirement accounts, and releasing monthly income; however, your projected retirement date may be delayed as a result.

Fat FIRE Vs Barista FIRE

In Barista FIRE, you keep a part-time or low-stress job in retirement for residual income and health insurance to help offset annual spending costs. Without even realizing it, a lot of people in the United States aim to “barista FIRE”—that is, they want to amass enough money to retire early or downgrade their career.

How Much You Need To Fat FIRE

According to my after-tax investment amounts by age, you need to amass the following amount of wealth if you want to live the Fat FIRE lifestyle in cities like San Francisco, New York, Los Angeles, Washington, DC, Boston, San Diego, Seattle, Miami, or now Denver.

I wouldn’t retire before the age of 40 if I wanted to live the Fat FIRE lifestyle and had less than $3 million in savings. The value of $1 million today is actually $3 million, thanks to inflation, which started in the 1980s and earlier.

Even with investments totaling $3,000,000 after taxes, you’ll only be able to make between $30,000 and $120,000 based on a 1% – 4% rate of return. It’s not a good idea to risk too much of your capital if you are Fat FIRE in this low-interest rate environment where valuations are very expensive.