Will Banks Cash A Ripped Check? It Depends

You unintentionally tore a check thinking you had already cashed it. Can a ripped check be cashed at the bank? It depends on how the check is cashed, the type of check, and how bad the rip was. In this article, you can learn how to handle a ripped check.

Will A Bank Accept A Ripped Check

A ripped check might be cashed with the assistance of some banks. Others view a damaged check as being worthless. It’s crucial to confirm that all of the information on the check is still legible if it’s torn.

Never attempt to glue or tape your check back if it tears unintentionally. This might worsen the situation. Visit the bank, present it to a teller, and kindly explain what transpired.

To see if they can process it, the teller will tape it back. If processing it is impossible, you will need to return it to the person who made the drawing, the bank where it was made, or the business where it was made, and request a replacement.

You might also need to void the check if you are the owner of it.

Do Banks Think A Ripped Check Is Valid

Because banks do not deal in risks, they will probably decline to cash a check if they have any reason to believe it is valid. A bank may be uncertain about a check for a variety of reasons, including:

- The amount on the check does not match the account balance

- There is no signature or the signature is illegible

- The check was post-dated

- It has been altered in any way

- The check is rejected by the machine when it is run through

If a check is only slightly damaged, a bank might occasionally cash a ripped one. This choice is not guaranteed and is left to the bank’s discretion. To learn more about your bank’s specific policies and what to do in this situation, you might want to get in touch with them.

You can send a photo of the check along with an email to their customer support staff so they can examine it and gauge its condition. If not, you can call them or go in person to your neighborhood branch.

Read more: How Can I Cash A Check Without An ID?

Types Of Rips On A Check

There are a number of ways that checks can be compromised or damaged because they are such flimsy forms of money. The following are some of the problems that a damaged check might cause:

- A small tear or rip that doesn’t affect any of the important information on the check

- a significant rip or tear that alters the signature, date, value, etc.

- A hole in the check caused by a staple or paper clip

- Water damage such as warping or staining

- The signature or other important information on the check is smudged or unreadable

- The tear/rip is too severe for the machine to process it

- The check has a corner or a section missing.

- There are ink marks on the front or back of the check – including when someone tried to make out what was written in the amount line

- The check is ripped or torn in half.

- The check has been completely crumpled or folded many times

- The check is dissolving or extremely thin from going through the washing machine

There’s a good chance your bank won’t accept the check if any of these problems apply to you. Some of these problems can, however, be fixed more easily than others.

Ways To Repair The Check

Attempt To Tape The Check Together Again

Simply using clear adhesive tape to tape or glue the check back together is the first step.

This might be the best option if there is only a small tear in one corner. Make sure the tape is totally clear and doesn’t cover up any of the writing on the check.

If There’s A Hole, Try To Patch It With Plastic Or Paper

Use some plastic or paper to try to patch up any holes left in your check from staples or paper clips.

This will only function if the section was empty of any crucial details like the signature, date, or amount. Tape a small piece of paper or plastic that has been cut to fit over the hole.

The check should be affected as little as possible, so use the smallest, most minimal piece of paper and tape you can. To ensure that a piece of paper blends in and is readable, use a neutral or white color.

If There’s A Smudge, Try To Clean It Off

In some circumstances, you can simply remove any smudges on the check with a small amount of water and mild soap. This, however, only removes light smudges.

Gently dab at the smudge with a Q-tip or small towel, being careful not to get it too wet or it will warp or dissolve.

An eraser can occasionally also remove dirt or ink from a surface. Just make sure the eraser isn’t too harsh and doesn’t harm the check in any other way.

The ink should come off by patiently and gently rubbing at it. Traditional pink erasers don’t work as well as white or kneaded ones.

Tape A Ripped Check Back Together

You can attempt to tape your check back together if it has been split in half or torn apart. Make sure the check is perfectly aligned so that you can see all of the information on it.

Use transparent, thin tape to repair the ripped seam while still enabling the check to be processed.

To avoid obscuring any writing on the torn check, especially where you’re going to sign it, make sure that both sides of the tape are completely transparent.

First, tape a small portion of the check together. The paper surface won’t be further harmed if you make a mistake because you won’t have to peel the tape back.

If The Check Is Warped, Try To Iron It Flat

You can try ironing the check flat if it has been warped as a result of water damage. It must be flat and legible in order for you to cash it.

Use a low-heat setting on your iron after placing a thin towel over the check. Be careful not to press too firmly as this could cause the check paper’s ink to fade due to heat.

To prevent unintentionally warping it more, carry out this process in small increments at a time while frequently checking the check.

Another option to help flatten the check is to use a hairdryer on the cool setting. However, be careful to avoid melting or damaging the paper.

Flatten A Check By Pressing It Between Books

You can sandwich the check between two unmarked hardcover books and apply pressure.

To help flatten it out, place a heavy object on top of the books. Make sure the check is completely flat by leaving it for a few hours or overnight.

What Is A Valid Check

A variety of parties may send you checks as payment. Checks are available from, for instance:

- Your employer

- Friends who owe you

- Investment platforms such as RealtyMogul

- website for surveys, such as Swagbucks, etc.

This means that before you even consider cashing a check, you must be able to recognize a valid check. You might not be able to deposit or cash it if any information is incorrect or missing.

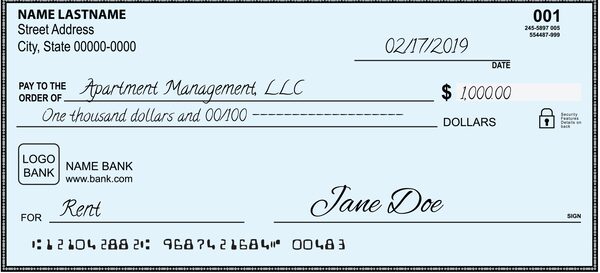

The following are some examples of valid check characteristics:

- An account number

- Check writers’ name

- The signature of the check writer

- An amount of the check both in, words and numbers

- The date the check was drawn

- The right check paper, length, and size

A special magnetic ink must be used when printing checks so that they can pass through bank check readers. A teller passes a check through the Magnetic Ink Character Recognition device, which recognizes the ink, to deposit or cash it.

Read More: